If you're using Google Trends data for statistical analysis, you will want to take a closer look at any seasonal patterns in the data. I've plotted three versions of the same search data, the raw data, the data where dummy variables for the months have been included, and one where dummy variables for the weekday ahve been included. The raw plot shows that there is a clear daily pattern in the data.

AstraZeneca

In the case of AstraZeneca, searches are the lowest during the weekend and the highest on Wednesdays.

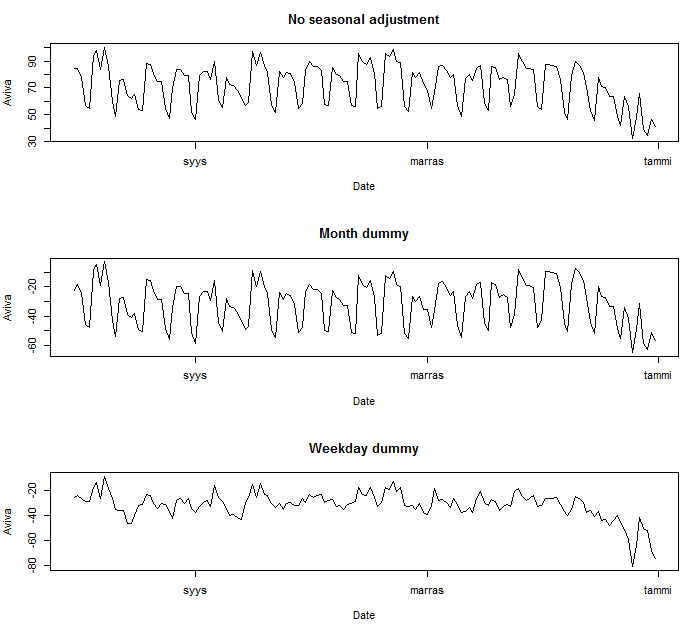

Aviva

Aviva

shares the same pattern as AstraZeneca. It seems as the interest for

Aviva and AstraZeneca follows the pattern of the working week. If the

search data represents financial interest, perhaps it shows that

investors take the weekend off.

BHP Billiton

Also BHP Billiton exhibit the same pattern with the search volume being the lowest on the Weekends and the highest on Wednesdays. A possible rule of thumb for the quality of search volume data for financial applications could be the display of such a pattern.

BAE Systems

And finally BAE Systems, again the same pattern of low search volumes on the weekends and high search volume on Wednesdays.

FTSE 100

No comments:

Post a Comment