The consensus forecast for King's Q2 2015 EPS was 0.36. Based on the amount of Google searches for King's main titles by the end of Q2, I predicted an EPS of 0.45. Now, the actuals are out, and the real numbers are somewhere in the middle.

At a realised EPS for Q2 at 0.41, the surprise against the consensus forecast was 13.89%. My estimate had a negative surprise of -9%.

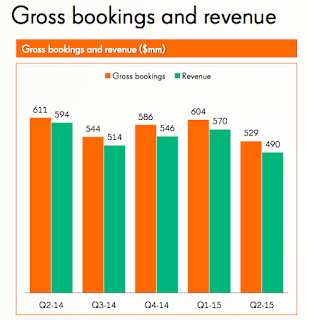

As for revenue, I forecasted Q2 revenue to be $517M. Actuals turned out to be lower by 5%, at $490M.

Showing posts with label forecast. Show all posts

Showing posts with label forecast. Show all posts

Tuesday, October 06, 2015

Wednesday, July 29, 2015

Twitter Q3 2015 MAU growth forecast

Twitter just released their Q2 earnings, and with their stagnating user growth in mind, I wanted to take a look at their expected user growth in Q3 given the current trend in Internet search volumes for Twitter.

Past log changes in monthly active users (MAU) has had a strong correlation with log change in average quarterly search volumes. That's what we'll use for the prediction.

Past log changes in monthly active users (MAU) has had a strong correlation with log change in average quarterly search volumes. That's what we'll use for the prediction.

Then, let's assume that the current search volume trend continues into Q3 (forecasted figures in red below).

Based on the historical correlation, we can then forecast the change in MAUs from Q2 to Q3.

That should mean an average of 335 million monthly active users in Q3. If we extend the forecast to Q4, that gives us 346 million MAUs.

Twitter has stopped growing in the US, and all the growth in Q2 is from abroad. Are there any markets where search volumes trends are positive? There are stable or slightly decreasing SVI volumes in Germany, Austria, Switzerland, Japan, Australia, and New Zealand.

The trajectory is negative in France, Spain, Italy, Ukraine, Russia, Indonesia, Brazil, South Africa, Canada, and Kazakhstan.

There only places I've found with a positive trend is Portugal, Argentina and South Korea.

It will be interesting to see how actual search volume interest develops during Q3.

Labels:

forecast,

google trends,

MAU,

monthly active users,

Q2 2015,

q3 2015,

svi,

twitter,

user growth

Monday, July 27, 2015

Has Supercell peaked?

Last year's revenue hit new record highs for the Finnish game maker, but the latest data from Google Trends show a worrying picture for their hit game "Clash of Clans".

Data from Google Trends show that interest for Clash of Clans peaked in February and has since been on a downward trajectory. The picture looks even worse if we look only at interest in the US.

Labels:

boom beach,

clash of clans,

forecast,

google trends,

hay day,

supercell

Wednesday, June 24, 2015

King Q2 2015 revenue forecast. Is the saga over for King?

Update 4 August 2015

The deterioration in search volume for King's main titles in Q2 2015 wasn't as bad as forecasted, thanks to an uptick in Candy Crush popularity in the last week. The consensus forecast for King's EPS for Q2 from Nasdaq puts EPS at $0.36. Based on the latest SVI data, I would expect King's revenue to be around $517 M. An EPS of $0.36 seems quite low. I would assume it to be close to $0.45.

The mobile game developer behind the Candy Crush Saga, King, had a record year in 2014, with revenue increasing 19% from the year before. But since then, things have changed. From the search volume for their top three titles, Candy Crush, Bubble Witch and Farm Heroes, we can see that none of the other titles have really taken off. What's worse, interest in their top title Candy Crush is going down.

What could this mean for revenues 2015? Revenue is already on a down trend. If we extrapolate out the search volume trend to the end of the year, the number of Google searches will have decreased by 43%.

The end of 2015 is of course half a year away, but if the trend continues, we should see a drop in King's revenue by 50% to $1105 M.

If we look a bit closer in time, ahead for Q2 2015, the same analysis puts revenue at $454 M. for the quarter. If we remove the first quarter 2013, that number goes up to $550, on par with the previous quarter.

The analysis is based on the assumption that Google searches equals general interest which translates into revenue. It's limited by the fact that Candy Crush accounts only for 50% of revenue, but is 95% of the search volume variation measure used here. A drop in new users wouldn't either translate into a direct drop in revenue, as existing users keep playing King's game.

The time of explosive growth looks to be over for King. If you have the analyst's revenue forecast for Q2, leave a note in the comments. How do you think the stock market will react to a continued revenue decline in Q2 2015?

Rovio forecasted revenue 2014 versus actuals

Back in March, I claimed that Rovio's revenue would decline from €153.5 M. to €152 M. The actuals are out, and it seems like I was only off by €4 M. Even better, the model could forecast a change in trend based on Google search data, which is very interesting to see.

The model used was slightly different from the one used for forecasting Supercell's revenue for the year. Previously I have worked with the direct correlation between revenue and search volume. This time, a log change model was instead used, and proved to be effective in this case.

Here's the previous post containing the forecast.

Financial ratio summary

Rovio Entertainment Oy

|

2010/12

|

2011/12

|

2012/12

|

2013/12

|

2014/12

|

|---|---|---|---|---|---|

Companys turnover (1000 EUR)

| 5232 | 75395 | 152171 | 153516 | 148332 |

Turnover change %

| 622.10 | 620.60 | 101.80 | 0.90 | -3.40 |

Result of the financial period (1000 EUR)

| 2600 | 35356 | 55615 | 25898 | 7964 |

Operating profit %

| 56.60 | 62.10 | 50.50 | 22.80 | 6.70 |

Company personnel headcount

| - | 98 | 311 | 547 | 729 |

Subscribe to:

Posts (Atom)